We’ve been hearing some very mixed things about the state of the repair and renovation market so far this year. At Eureka, we believe that installers are a fantastic barometer of demand for trades out there in the real world. The sentiment of these sole traders and small businesses tells us a lot about the health of the property renovation, RMI and potentially broader economy too.

This article provides our latest data and insight from a recent quick-fire consultation with tradespeople in May. We put a particular focus on those working in the bathroom, kitchen, plumbing and heating sector.

How are enquiries and the work pipeline looking for tradespeople?

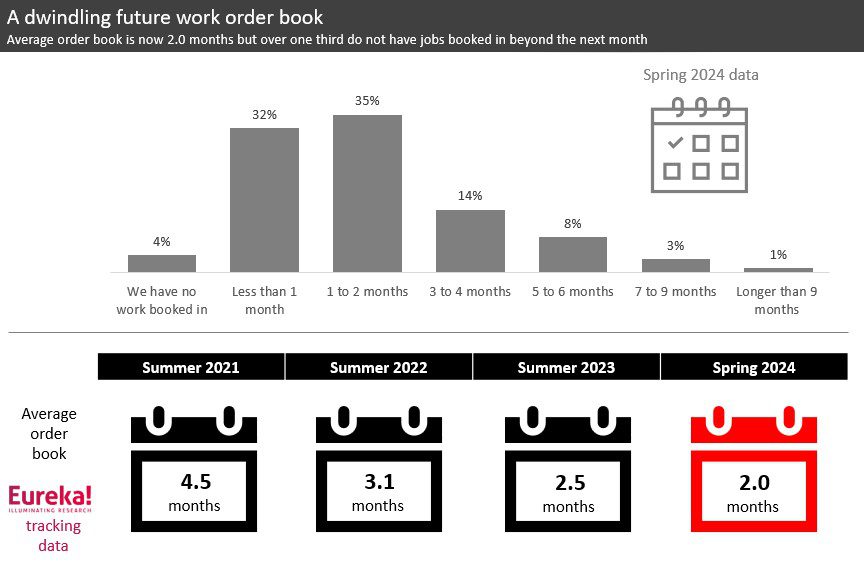

A healthy order book is the one thing that gives small businesses confidence and optimism about the market. So how are things looking out there in May? We asked our trade community how far in advance they currently have worked booked in. The results are not particularly reassuring but tally up with what we have been hearing from clients and stakeholders across the RMI and new build sector.

Our latest data show over one-third of installers have an order book of less than one month, or none at all. Overall this means that the average tradesperson in this sector has just 2.0 months of confirmed work ahead.

Whilst this might sound reasonable to some people, it’s the direction of travel that is most concerning. Certainly, when we first started tracking this metric at the height of the ‘Post Covid’ boom, an average of 4.5 months always felt excessive and potentially problematic from an operational perspective. Installers tell us that an excessive order book means too many moving variables, too much headache and material costs can go up of course.

Since 2021, however, our data clearly indicate a steadily declining picture – taking us down to the average of 2.0 months we see today. Let’s hope that this is the bottom of the curve.

What sort of work is ‘drying up’?

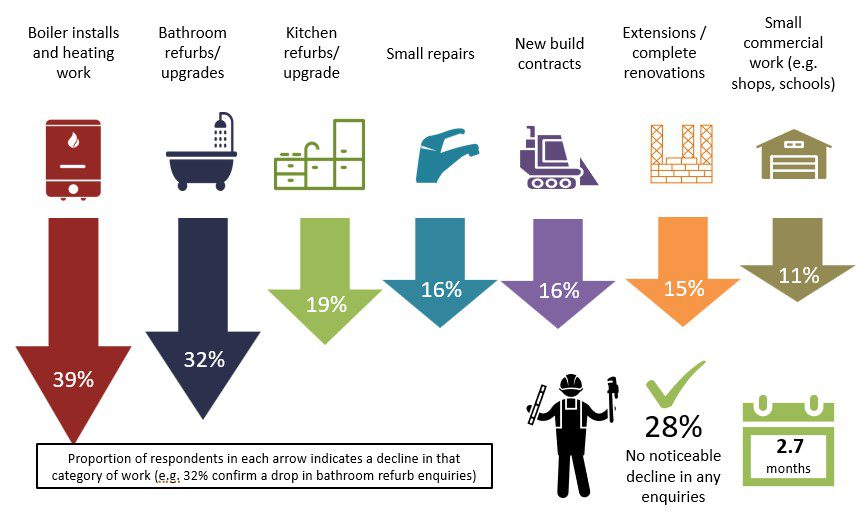

So is demand for trades dwindling across the whole market, or is there a loss of demand with certain types of job? We were interested in how this looks across the average work portfolio. So we asked tradespeople: “Compared to 12 months ago, in which of the following areas have you seen a noticeable decline in enquiries, if any?”

The first thing to note is that over 7 in 10 tradespeople report at least one type of job enquiry declining over the past 12 months. Our data show that heating work and full, big-ticket bathroom upgrades are under the most downward pressure

Larger sorts of jobs (house extensions, or contracts through bigger builders) appear to be fairly resilient for now; as do smaller call-outs for repairs. Just 1 in 6 tradespeople reported a decline in those sorts of enquiries. Interestingly, work via the commercial sector was only selected by 11%. This suggests that those who have secured on-going maintenance work or contracts with clients have got themselves a relatively steady pipeline of work.

But some installers are bucking the trend. 28% of our respondents claim that they haven’t had a noticeable decline of job enquiries at all. As you might expect these businesses are feeling more optimistic because they have managed to maintain their pipeline of work. Analysis shows that these more resilient trades have an average order book of 2.7 months.

Why is demand so ‘sluggish’ in the repair and renovation market?

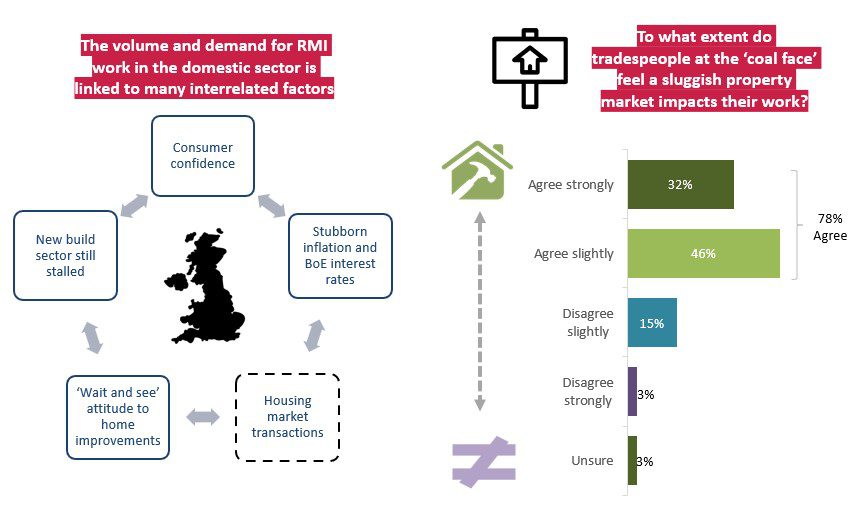

Clearly, diagnosing the problem is easier said than done. The volume and demand for trades and RMI work in the domestic sector is linked to many interrelated drivers. One common factor that is mentioned by many commentators in this sector however is the housing market more generally.

Which? have compiled some solid data on house prices, transactions and estate agent enquiries this month; soberingly, they all point to a property market that remains very FLAT.

So why should we be concerned about this? Many studies have shown that homeowners are more likely to invest in big-ticket items, such as a new kitchen or bathroom, after moving in to a new property, or to help them sell a house in the first place. So if the number of transactions is not buoyant we can reasonably expect the repair and renovation market to be flat as a pancake.

Installers and tradespeople seem to agree with this simplified observation about the market. Infact, over three-quarters of tradespeople believe there is a correlation between a slow housing market and weaker demand for trades and their services at the moment. Only one-third strongly agreed with statement this though, suggesting that this isn’t the only thing holding back the market currently.

Please note. The question we asked here was: Do you agree or disagree that a slower housing market means less work for you (i.e. less people looking to sell, or improving a newly purchased home)?

Implications for brands in KBB and plumbing sector

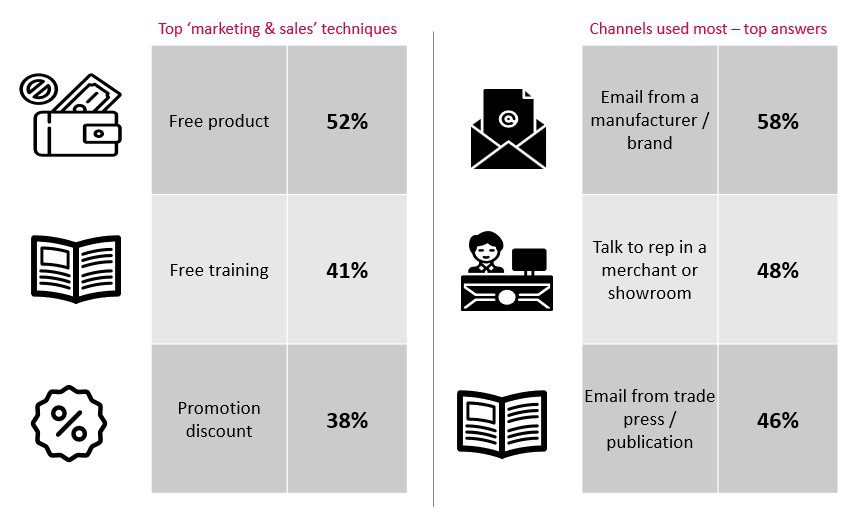

A depressed market – and low demand for trades – has some obvious implications for the volume of product being purchased in the sector. Brands will also be fighting for every pound in the tradesperson’s wallet and looking to dislodge product loyalty and encourage switching.

We took the opportunity to ask installers what would catch their attention and influence them to try and new product; and what channels do they actually have time to absorb information.

It is interesting that some of the old ‘tried and trusted’ channels are still top of the pile for installers. A good old-fashioned email campaign into the inbox can still work very effectively, and of course we know that tradespeople like to engage with knowledgeable representatives in the merchant environment if they have time too.

For reference, the questions asked above were:

- Thinking of all the products you need to buy for a bathroom job, which of the following would encourage you to try something new? (Please tick all options that apply to you)

- Considering a typical working week, which of the following do you have time to do? (Please tick all options that apply to you)

There’s a lot more data sitting underneath these questions. If you have a responsibility for marketing strategy and are interested in seeing the full breakdown of answers then do please get in touch.

Data collection: Eureka trade community

We have our own highly engaged community of tradespeople that we use for both client projects and our own research (such as this). Our database includes a variety of sole traders, contractors, and small businesses (across many trades) who we can turn to quick tactical feedback, or more in-depth exercises to inform strategy. Take a look here for more information.

We’ve learned how challenging it is to get the attention of busy tradespeople. On our journey to becoming the leaders in trade market research in the UK, we have developed our own ‘tricks of the trade’ to keep respondents engaged in a multitude of research assignments. This includes engaging our database with short, snap surveys of topical questions with quick turnaround prize bundles to reward our community. If you would like to take advantage of this fantastic resource, then give us a shout.

The data reported in this article was conducted online and via SMS from Friday 3rd May – Tuesday 7th May 2024 by Eureka! Research. 168 interviews were completed with tradespeople, with a bathroom and kitchen installation, plumbing or heating work profile.

For more information about Eureka’s work in the plumbing and heating category please click here.